Understanding Attorney Tax Law: A Comprehensive Guide

Attorney tax law is a specialized area encompassing the tax obligations and implications for legal professionals and their clients. In today's complex financial environment, understanding attorney tax law is crucial for anyone in the legal field, whether you are an attorney, a law firm administrator, or a client hoping to navigate the legalities of taxation. At AJA Law Firm, we aim to demystify this critical aspect of law and provide you with the knowledge you need.

What is Attorney Tax Law?

Attorney tax law is a branch of tax law specifically focused on the regulatory framework governing the taxation of legal professionals. This area covers various important topics, including:

- Income Taxation: How attorneys and law firms report their income and pay taxes on earned revenue.

- Deductible Expenses: Understanding what business expenses can be tax-deductible, such as office supplies, legal research costs, and continuing education.

- Client Tax Implications: How attorneys can advise clients on the tax consequences of legal settlements or judgments.

- Entity Structure: Choosing between various business structures (e.g., sole proprietorship, partnership, LLC, corporation) and how these choices affect tax obligations.

The Importance of Understanding Tax Obligations

For attorneys, understanding their tax obligations is essential not only for compliance but also for building a thriving practice. Here are some critical reasons why grasping attorney tax law is vital:

1. Compliance with IRS Regulations

The Internal Revenue Service (IRS) has stringent regulations that govern how attorneys must report their income and expenses. Violating these regulations can lead to severe penalties, including fines and loss of professional licenses. Familiarizing oneself with these regulations helps attorneys comply with legal requirements and avoid unnecessary complications.

2. Maximizing Deductions

Attorneys are entitled to various business expense deductions that can significantly reduce taxable income. Knowing what is deductible—from office rent to marketing expenses—can keep an attorney's tax burden manageable. Proper tax planning can lead to substantial savings, maximizing profits and enhancing practice sustainability.

3. Advising Clients Effectively

Attorneys often assist clients with tax-related issues, such as the tax implications of settling a case. Whether it involves personal injury claims, criminal defense matters, or other legal disputes, understanding the nuances of attorney tax law enables attorneys to provide better service and safeguard their clients’ interests.

4. Business Structure Considerations

Choosing the right business structure is an important decision for any attorney. Each structure—whether solo practice, partnership, or corporation—comes with its own tax implications. An attorney knowledgeable in tax law can advise on the most beneficial structure for their practice, aligning it with long-term business goals.

Types of Taxation Relevant to Attorneys

Different types of taxation may apply to attorneys, influencing their practice and client interactions. The most pertinent types include:

1. Federal Income Tax

All attorneys must pay federal income tax on their earnings, which includes fees received for services rendered. Understanding the federal tax brackets, estimated tax payments, and allowable deductions is crucial for effective financial management.

2. State and Local Taxes

In addition to federal taxation, attorneys must also comply with state and possibly local tax laws. Depending on the jurisdiction, these taxes can range from sales tax on legal services to state income tax on earnings. Being aware of these obligations helps prevent unexpected liabilities.

3. Self-Employment Tax

Many attorneys operate as self-employed individuals or sole proprietors; thus, they become responsible for self-employment tax. This tax covers Social Security and Medicare taxes, which are generally withheld by employers. Understanding the implications of self-employment tax is essential for accurate financial planning and budgeting.

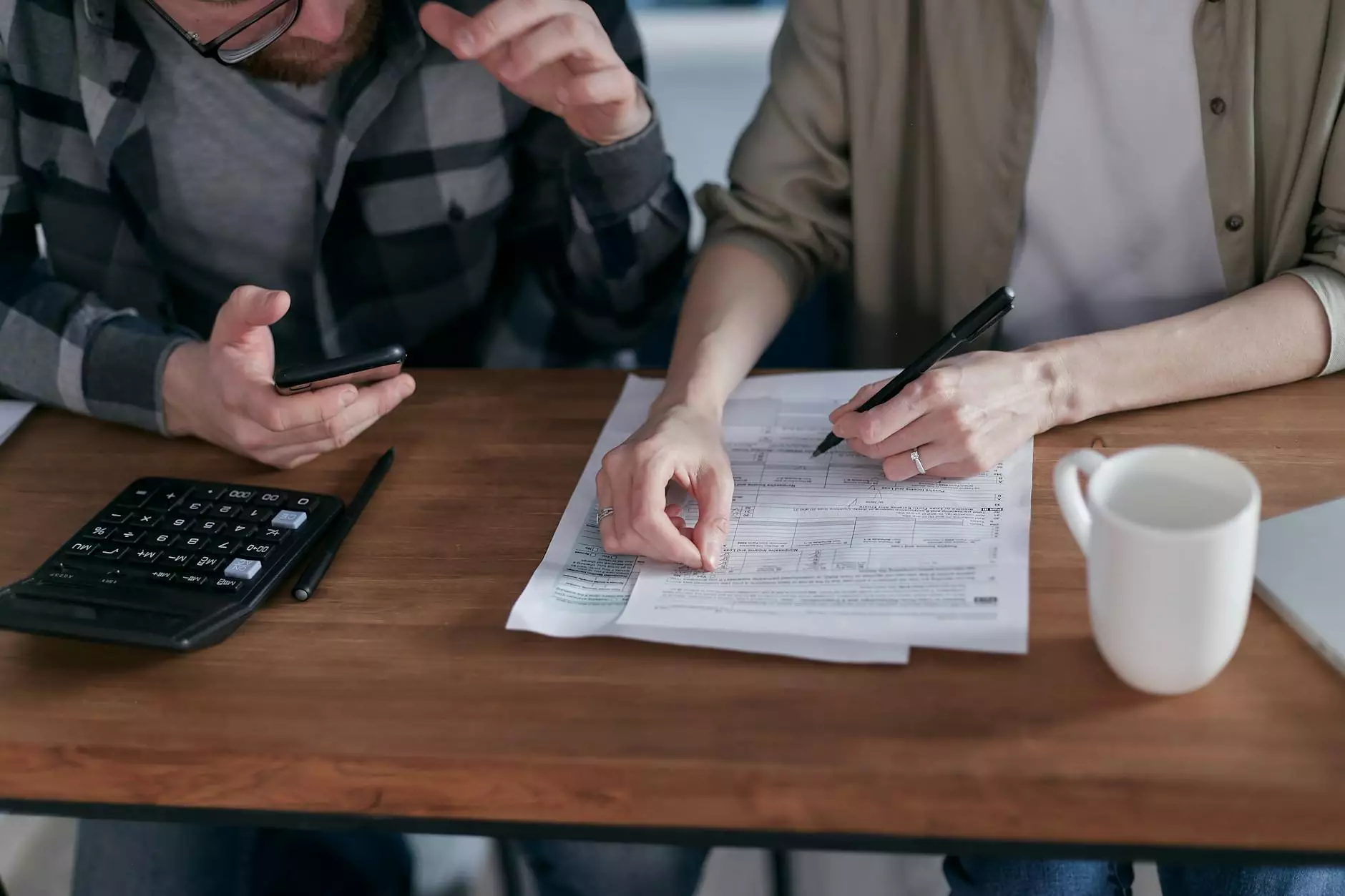

Strategies for Tax Planning

Effective tax planning is essential to minimize liabilities and enhance profitability. Here are some strategies attorneys can implement:

- Maintain Accurate Records: Keeping meticulous records of all income and expenses can simplify the tax filing process and help in claiming deductions.

- Engage in Tax Planning: Working with a tax professional to develop a tax strategy can identify opportunities for savings and ensure compliance with current laws.

- Consider Contributions to Retirement Plans: Contributing to retirement accounts can provide tax advantages while also saving for the future.

- Stay Informed on Tax Law Changes: Federal and state tax laws change frequently. Keeping abreast of these changes ensures attorneys adjust their practices accordingly.

Common Tax Issues Faced by Attorneys

While understanding attorney tax law can significantly alleviate tax-related challenges, some common issues persist in the legal profession, including:

1. Misclassified Employment Status

A significant issue for many attorneys is the misclassification of employees vs. independent contractors. Misclassifying a worker can lead to fines and back taxes. It is crucial to understand the IRS criteria for classification to avoid these pitfalls.

2. Failure to Report All Income

All earnings, including cash or barter fees, must be reported to the IRS. Oversight or intentional failure to report income can lead to audit triggers and subsequent penalties.

3. Inadequate Record-Keeping

Inadequate record-keeping can result in lost deductions and increased audit risk. Implementing an organized record-keeping system is vital for all accounting practices.

The Role of Professional Tax Advisors

Given the complexities of attorney tax law, many legal professionals choose to enlist the services of a tax advisor. Here’s why:

1. Expertise in Tax Law

Tax advisors possess specialized knowledge that can help attorneys navigate the intricate landscape of tax regulations, ensuring compliance and optimization of taxes.

2. Time Efficiency

Managing taxes can be time-consuming, detracting from the time attorneys should prioritize on cases. A tax advisor takes over this responsibility, allowing attorneys to focus on their practice.

3. Risk Mitigation

Experts can help minimize legal risks associated with tax disputes, audits, and penalties, providing peace of mind to attorneys and their clients.

Conclusion

Understanding attorney tax law is critical for any legal professional committed to running a successful practice. With the right knowledge and resources, attorneys can navigate the maze of tax obligations, maximize deductions, and provide informed guidance to their clients at AJA Law Firm. Regular collaboration with tax professionals, continuous education, and efficient record-keeping can transform tax management from a burden into an advantage.

By prioritizing this aspect of practice management, legal professionals can not only secure compliance but also foster growth and sustainability in their legal careers.